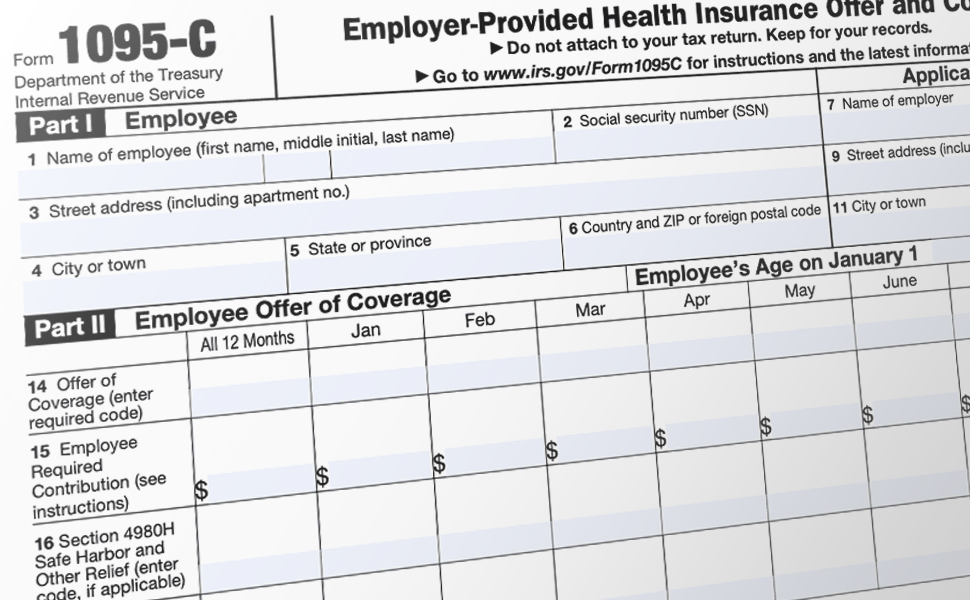

About the Form 1095-C

Full time employees of the Commonwealth of Massachusetts, including institutions of higher education, the Massachusetts Bay Transit Authority (MBTA), or Massachusetts School Building Authority (MSBA) who work an average of 30 or more hours per week must be provided a Form 1095-C. This is a requirement of the Affordable Care Act.

Electronic Forms 1095-C are now available via HR/CMS Employee Self-Service Time and Attendance. Employees can view this by selecting “Benefit Details”, then “View Form 1095-C”.

Paper Forms 1095-C were mailed by March 1, 2025 to the employee’s home address.

Forms 1095-B and 1095-C should be kept with tax records. Do not submit them to the IRS or Massachusetts Department of Revenue.

VIEW FORM 1095-C PRINTABLE INSTRUCTIONS

If you have questions about your Form 1095-C (the offer of health insurance coverage) issued by the Commonwealth of Massachusetts (including institutions of higher education), the MBTA, or MSBA, call your human resources department.

If you have any questions about a Form 1095-B (offer of health insurance coverage) from the GIC, please see the Form 1095-B Frequently Asked Questions. You can also visit the IRS website.